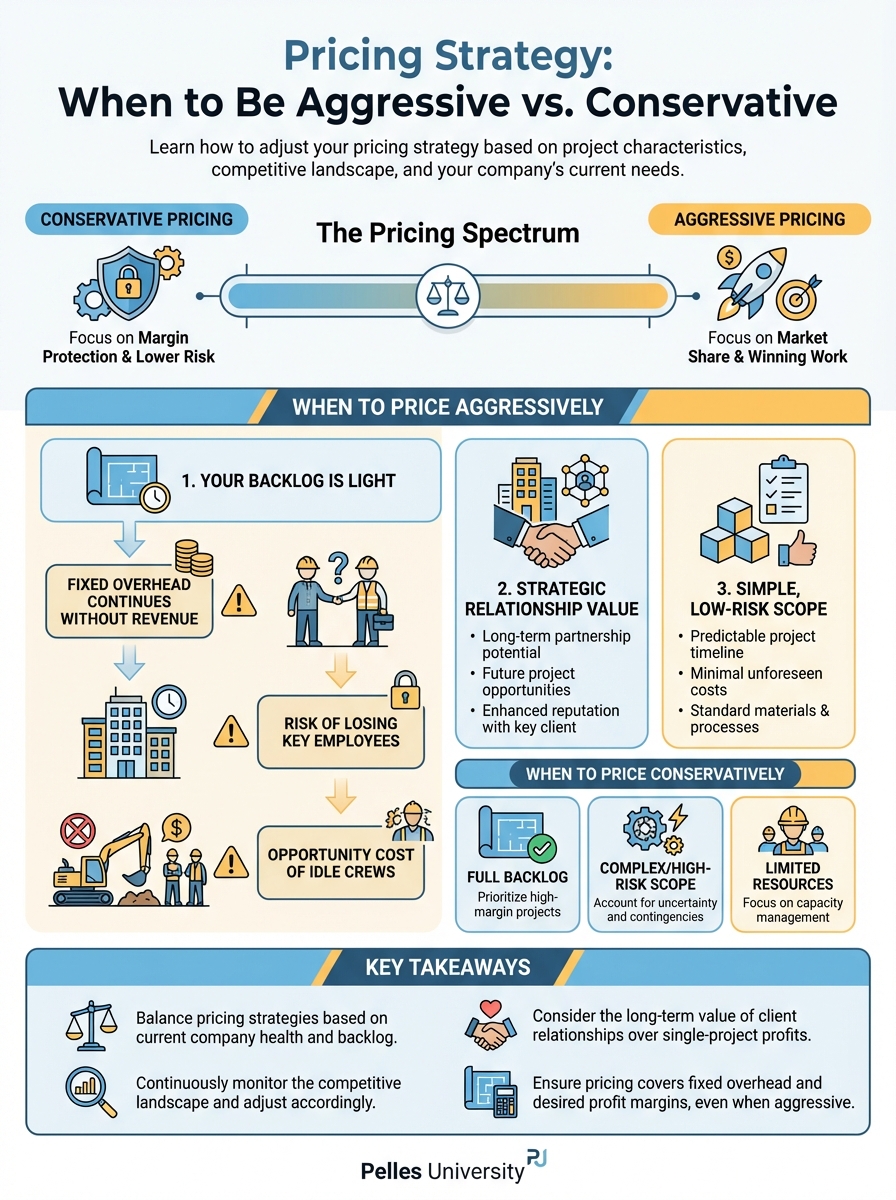

Not every bid deserves the same margin. Some projects warrant aggressive pricing to win. Others justify premium margins for the risk involved. Knowing the difference separates contractors who stay profitable from those who wonder where the money went.

The Pricing Spectrum

Think of your pricing as a range:

| Strategy | Margin | When to Use |

|---|---|---|

| Aggressive | 5-10% | Need work, low risk, strategic value |

| Standard | 12-18% | Normal projects, typical risk |

| Conservative | 20-30% | High risk, complex scope, resource constraints |

| Premium | 30%+ | Extraordinary risk, specialty work, sole source |

Your baseline margin covers overhead and provides reasonable profit. Adjust up or down based on factors that change the equation.

When to Price Aggressively

Your Backlog Is Light

Empty backlog means:

- Fixed overhead continues without revenue

- Risk of losing key employees

- Opportunity cost of idle crews

Sometimes winning work at thin margins beats the alternative. A 5% margin job keeps people employed while you pursue better work.

Strategic Relationship Value

Consider aggressive pricing when:

- It's a new GC you want to build history with

- The owner is someone you want repeat work from

- Success here opens doors to larger opportunities

The lifetime value of a client relationship often exceeds single-project margins.

Simple, Low-Risk Scope

Some projects genuinely warrant lower margins:

- Clear, complete documents

- Familiar building type

- Reasonable schedule

- Good GC with payment history

- Scope you've done many times

Low risk = lower margin is acceptable.

Competitive Intelligence Suggests Tough Field

When you know competitors are hungry or pricing aggressively:

- Price to win, not to wishlist

- A thin win beats a comfortable loss

- Protect your position in the market

When to Price Conservatively

High-Risk Contract Terms

Add margin for:

| Risk Factor | Margin Adder |

|---|---|

| Liquidated damages | +2-5% |

| No-damage-for-delay clause | +2-3% |

| Aggressive retainage (>10%) | +1-2% |

| Pay-if-paid terms | +2-4% |

| Broad indemnification | +1-3% |

| Short warranty period definition | +1-2% |

These risks have real costs. Price accordingly.

Complex or Unclear Scope

When documents leave questions:

- Incomplete drawings

- Conflicting specifications

- Undefined interfaces

- "Coordinate with others" language

Uncertainty = higher contingency = higher price.

Schedule Pressure

Tight schedules cost money:

- Overtime and premium time

- Acceleration inefficiencies

- Stacking with other trades

- Compressed procurement

If the schedule looks aggressive, your price should reflect it.

Your Backlog Is Full

When you have plenty of work:

- No pressure to win at any cost

- Opportunity cost of taking lower-margin work

- Resource constraints mean this project competes with better ones

Price for the work you want, not the work you need.

Problem GC or Owner

Some relationships warrant premium pricing:

- Slow payment history

- High change order dispute rate

- Difficult project management

- Excessive documentation requirements

Your margin should compensate for the headache factor.

Project-Specific Pricing Factors

Building Type Adjustments

| Building Type | Margin Tendency |

|---|---|

| Industrial/warehouse | Lower (simple, repetitive) |

| Office | Standard |

| Healthcare | Higher (complexity, infection control) |

| Data center | Higher (critical systems, redundancy) |

| Renovation/occupied | Higher (access, phasing, unknowns) |

Geographic Factors

Consider:

- Travel distance and time

- Local labor availability

- Permitting complexity

- Inspector requirements

Remote projects with unfamiliar jurisdictions warrant higher margins.

Procurement Complexity

Long lead times and specialty equipment add risk:

- Price volatility exposure

- Storage and handling

- Coordination complexity

The Competition Analysis

Known Competitors

When you know who's bidding:

| Competitor Type | Your Response |

|---|---|

| Low-margin competitor | Price competitively if you want it |

| Quality-focused competitor | Emphasize value, hold margins |

| Struggling competitor | They may buy the job—decide if you want it |

| Specialty competitor | They may have advantages—consider your position |

Unknown Competitors

Assume unknown competitors are:

- Potentially aggressive

- Possibly misunderstanding scope

- Maybe desperate for work

Don't race to the bottom against unknowns, but don't ignore the reality either.

Pre-Bid Intelligence

Gather information:

- Who's picking up drawings?

- Who's attending pre-bid meetings?

- What's the GC's bidding pattern?

- Is this a "check the box" bid or real competition?

Margin Protection Strategies

Qualifications and Exclusions

Protect margins by clarifying scope:

- List specific exclusions

- Define what's included in allowances

- Clarify interface assumptions

- Note schedule assumptions

This lets you price tighter without taking unpriced risk.

Alternates and Value Engineering

Offer options that protect base bid margins:

- Deduct alternates for risky scope

- Add alternates for owner choices

- Value engineering suggestions

You might win on base bid and make margin on alternatives.

Escalation Clauses

For long-duration projects:

- Material escalation provisions

- Labor rate adjustments

- Index-based pricing for portions

These protect margin on work you haven't bought yet.

Making the Final Decision

Before submitting, ask:

- Do I want this job? At this price, with these terms?

- Can I execute it? Resources, schedule, capability?

- What's the real margin? After all risks are considered?

- What happens if I win? Does it help or hurt the business?

- What happens if I lose? Can I live with that?

Sometimes the right answer is: price it high and let it go.

Using AI for Pricing Decisions

AI can help analyze historical data:

Review my bid history for the past 2 years:

- Win rate by GC

- Average margin on wins vs. losses

- Project types where I'm most competitive

- Contract terms that correlate with problems

What patterns should inform my pricing strategy?

What's Next

Pricing strategy relies on understanding your costs. The foundation is accurate labor and material estimates. But the real insight comes from analyzing your completed projects—mining historical data for better future estimates.

TL;DR

- Not every bid deserves the same margin—adjust for risk and circumstances

- Price aggressively when backlog is light, risk is low, or relationships are strategic

- Price conservatively for complex scope, bad contract terms, or difficult clients

- Know your competitors and adjust accordingly

- Use qualifications and alternates to protect margins

- Sometimes the right answer is to let a job go